Boom time for Big Tech in payments?

John Chaplin at The Payments Innovation Jury outlines the findings of the recent research into payments innovation and the implications for the broader Big Tech industry

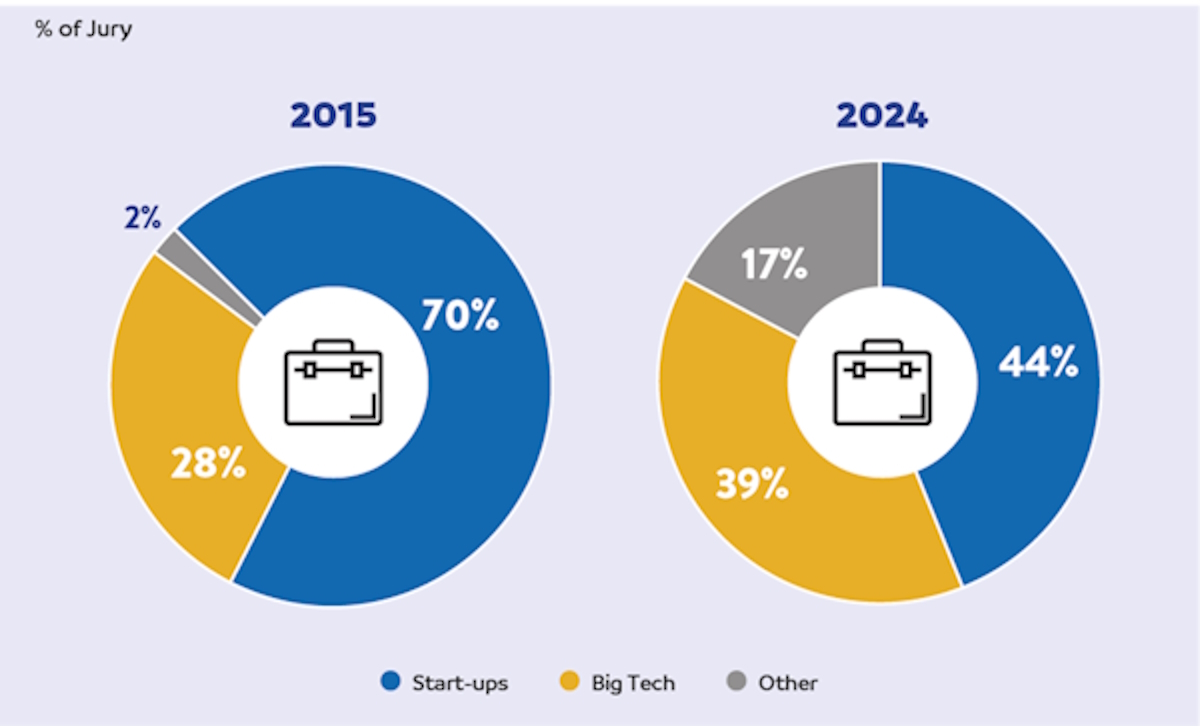

Recent research has revealed that the innovation playing field is starting to tilt towards Big Tech. At the moment, payments leaders still see start-ups as leading the game, but the gap with Big Tech is narrowing – and at the current rate, could soon disappear.

Back in 2015 when global payment experts looked at the same issue, they found that three times as much payments innovation would come from start-ups as from Big Tech. But now the delta has dropped to just 5%.

There are multiple factors driving this. It is well documented that fintech investment, especially in payments, is around 70% down on previous levels, with the reduction hitting both startups and scaleups hard. By and large, these are the companies that have been the driving force behind so much recent payments innovation.

Cutting off the life blood of investment seems very likely to have a material impact on innovation. Assuming that the very best ideas will still be funded, the overall reduction won’t be as bad as the overall investment reduction, but we are looking at a significant downshift in innovation unless the investment levels bounce back fairly quickly.

But the swing towards Big Tech isn’t just down to the investment drought. The Payment Innovation Jury’s latest research shows that the meteoric rise of AI technologies has the potential to make Big Tech a much bigger force in the payments world. And the key factor here is not AI applications such as ChatGPT, which start-ups will be able to take advantage of as well as anybody else. The big deal is the access to data.

In stark terms, Big Tech players such as Apple and Google know so much more about our transactional lives as consumers than any payments start-up can ever imagine. This has a straightforward consequence: they can build and train better models.

Deploying the models in new services and really influencing what and how we all buy could well be El Dorado for Big Tech. And what senior payments leaders globally see is that access to data is asymmetric; Open Banking makes consumers financial transactions available to the likes of Apple and Google (although they already have a lot of that already) but payments providers don’t have reciprocal access.

There was always a risk that regulatory initiatives such as Open Banking, which were designed to increase competition between conventional payments players and new market entrants that were largely playing the conventional game, albeit with a new twist, would not play out as intended. The research shows that AI combined with Open Banking and Open Finance could have just created the major financial services opportunity for Big Tech that has largely been eluding them for many years.

Maybe the regulators will try to correct any market imbalances that arise, given that Big Tech is now in their sights…but given how quickly payments and financial services are moving compared to the regulators, I wouldn’t bet on it.

John Chaplin founded The Payments Innovation Jury in 2008; it is a not-for-profit initiative that gathers the views on innovation from industry leaders around the world and has been convened 12 times since its creation

Main image courtesy of iStockPhoto.com and Tero Vesalainen

Business Reporter Team

Most Viewed

Winston House, 3rd Floor, Units 306-309, 2-4 Dollis Park, London, N3 1HF

23-29 Hendon Lane, London, N3 1RT

020 8349 4363

© 2024, Lyonsdown Limited. Business Reporter® is a registered trademark of Lyonsdown Ltd. VAT registration number: 830519543